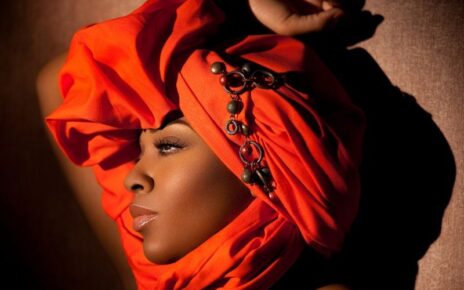

Florida’s Tinder Swindler (Brain Brainard Wedgeworth), A con artist and white collar criminal milked Tekesia Johnson.

Ms. Tekesia Johnson

felt ready for another chance at love. Her new business venture held promise, her two children were grown and the romantic reservations she formed after her failed engagement had since subsided. It seemed time to find someone – a man who shared her sense of ambition.

The Jacksonville woman searched for suitors in May 2017 on Plenty of Fish, one of the most popular dating websites owned by Match Group, the world’s top online dating service company. Johnson, one of 150 million registered users on the site, felt confident she would find a worthwhile match. That did not happen.

Like tens of thousands of other Americans who engage in online dating, Johnson said she was scammed. She warned her daughter and shared her story through local media appearances.

Wedgeworth never hid his true appearance when communicating with his alleged victims. He sent these images to Johnson as a way to authenticate his identity, and she said he even asked that she FaceTime him to ensure that she was not a scammer.

Wedgeworth never hid his true appearance when communicating with his alleged victims. He sent these images to Johnson as a way to authenticate his identity, and she said he even asked that she FaceTime him to ensure that she was not a scammer.

Brian Brainard Wedgeworth, 46, swindled Johnson of thousands of dollars in 2017, federal prosecutors said. A grand jury indicted him in October, and he was arrested in Nashville shortly afterward.

Wedgeworth, who prosecutors said is known by at least 13 aliases and has remained in federal custody, is expected to plead guilty Thursday morning in federal court in Tallahassee. If convicted, he faces up to 20 years in prison for wire fraud and mail fraud as well as 10 years for money laundering. Prosecutors believe that he scammed at least 21 women across eight states and amassed over $750,000 through years of schemes.

It’s unclear whether Wedgeworth would be able to reimburse any of his accusers from the money prosecutors say he stole from them, if the judge orders restitution in the case.

Prosecutors said his ex-wife lives in Tallahassee, but Wedgeworth has no home of his own. “When he is not in prison, the defendant typically lives with the women he victimizes,” Assistant U.S. Attorney Justin Keen wrote to the judge. The judge agreed with prosecutors that Wedgeworth was so dishonest he couldn’t be trusted to remain free between his arrest and trial.

Johnson and the women represented in Wedgeworth’s indictment – most were not identified by name, and a few identified only by initials – say the Alabama-born romance scammer made them believe he was a single surgeon looking to settle down.

Romance scams typically take place over online dating platforms and involve one party feigning romantic interest to earn another’s trust and access their finances. They have grown more common and costly. The FBI reported monetary losses in romance scams amounted to more than $1 billion last year.

This reporting is based on a five-month investigation of Wedgeworth and the case against him, including a review of records in his federal court case and more than 400 pages of police reports and court documents from states outside Florida where he has been accused – and in some cases convicted – of similar conduct.

It is also based on interviews with Wedgeworth’s sister, Juanicca Wedgeworth, and Johnson’s oldest daughter, Tiffany Maximin, as well as excerpts from Johnson’s social media posts and podcast interviews. Johnson died one month before Wedgeworth’s indictment, but she spoke in 2017 to a Jacksonville television news station about her encounter with Wedgeworth.

Romance fraud has proliferated alongside a steady incline in usership of online dating platforms. More users means more prospective victims.

Wedgeworth has earned the moniker the “Casanova Scammer” over accusations that he made a career of targeting women in search of romance. The indictment said he impersonated a wealthy doctor and surgeon. He has pleaded guilty to similar charges before, including to dozens of counts of fraud and forgery in Georgia and Alabama. When he was arrested in Tennessee last year, he was also wanted by law enforcement in Ohio and Alabama, court records showed.

Wedgeworth declined through his lawyer, Joseph DeBelder, to discuss the case against him. “Wedgeworth will not be speaking to any media under the advice of his counsel,” said DeBelder, Wedgeworth’s public defender.

Outside the federal case, at least seven women in five counties primarily across the Southeast have filed police reports against Wedgeworth for fraud. Online forums have sprung up to connect his possible victims. And, like Johnson, some have devoted hours to launching amateur investigations into his whereabouts before he was arrested in Tennessee.

Johnson scoured through social media and appeared on television, but she never managed to track down Wedgeworth after he vanished from her life. She never knew she had a chance at redemption, either.

Johnson died one month before Wedgeworth was charged, but her story is almost certain to play a role in determining the outcome of the federal case in Tallahassee.

Trapping Tekesia Johnson

Johnson thought she had her trajectory mapped out.

She had been comfortable around hair since she was a teenager, cutting and braiding for friends and family when they couldn’t afford salons. She knew the importance of image.

When her mother, Jacqueline Brown, suffered kidney failure, Johnson watched as she lost not only her hair but her confidence. Johnson searched for treatments and styles to counteract Brown’s hair loss, to help her regain control. Some methods showed results that encouraged both mother and daughter. Then Brown passed away in 2016.

Johnson lost her biggest supporter, but she gained the inspiration to make a leap. She left her career as a medical coder to open a salon and spa in Jacksonville: Perfected Creations. She wanted to help others find and boost their confidence, like she had done for her mother in her final moments.

The business plan signified a new chapter in Johnson’s life and made her excited for the future. One piece missing was a partner.

Johnson created a Plenty of Fish account to start dating. The platform is reputable and free to use. She began messaging a man who identified himself as Brian L. Adams in May 2017. Adams told her he was a thoracic surgeon. He seemed educated, passionate and cautious. He asked Johnson to FaceTime him to confirm her identity. That made her feel safe – she could trust him. But at some point he questioned Johnson about her financial status. That was a red flag for Johnson.

Wedgeworth’s alleged victims, including Tekesia Johnson, say he worked to ensure that his suitors trusted him before advancing with financial requests. Conversations between Wedgeworth and Johnson are pictured in these screenshots. She provided the images to Tenikka Hughes at Action News Jacksonville before Johnson passed away.

Wedgeworth’s alleged victims, including Tekesia Johnson, say he worked to ensure that his suitors trusted him before advancing with financial requests. Conversations between Wedgeworth and Johnson are pictured in these screenshots. She provided the images to Tenikka Hughes at Action News Jacksonville before Johnson passed away.

She told Adams she was broke. If he were a scammer, she thought that surely he would lose interest.

He didn’t.

Adams said he was searching for someone to settle down with and marry. He told Johnson he needed his future wife to be financially stable, so he offered to support her by paying off her debts. The gesture signaled to Johnson that he saw a future for the two of them. Adams sent her more than $20,000 for her mortgage within a few days of their fledgling relationship.

Johnson was 46, a single mother of two and had just endured a loss. Despite her suspicions about Adams’ generosity, she gave him a chance. After all, she was looking to settle down, too. Then he asked her for a favor.

He requested that Johnson deposit money into separate bank accounts in exchange for paying off her credit card balance and mortgage. He also asked Johnson for a Rolex watch. If she could finance it, he told her, he would pay her back. That way the purchase could help her build credit. On paper it would only stand to benefit her. He framed it as another act of generosity.

Skeptical, Johnson didn’t feel comfortable financing a Rolex. But she still held some faith in him. She spent $3,000 on two lesser-brand Movado watches. Adams met Johnson at Jacksonville’s St. Johns Town Center Mall to pick up the watches she purchased.

That’s when her fears were realized. Johnson received word from her bank that Adams’ attempts to pay off her bills had bounced due to non-sufficient funds. She Googled him. A thorough search yielded Adams’ mugshots under the name Brian Wedgeworth.

Wedgeworth had been jailed in DeKalb County, Georgia, for similar instances of fraud. In June 2014, three years before he met Johnson, Wedgeworth pleaded guilty to forgery in the first and third degree, identity fraud and driving with a suspended license.

Embarrassed, Johnson blamed herself.

Her bank prevented the fraudulent payments from processing, but she never got back the $3,000 she spent on watches. The cost of the watches set Johnson behind on paying her bills and pushed back her business plans by months.

She shared her story with her then 25-year-old daughter, Tiffany Maximin, as a cautionary tale. Johnson did what she could to warn others. She appeared on local TV news and shared her story across her social media; she knew just how easy it was to lose big. Yet despite her best efforts, other victims followed.

Anatomy of the scam

The tactics that Johnson said Wedgeworth used against her are not unique – but they can be effective.

He used at least 13 aliases, most a variation of his own name: Brian Mims, Brian Adams, Brian Anderson, Brian Edmonds, Brian Ammerson. He claimed to be affiliated with at least eight different reputable hospitals. His scams have reportedly taken place over at least 10 dating platforms and roped in nine banks through false checks and wire transfers, according to court records.

Successful scams are built on trust and deceit. Prosecutors said Wedgeworth garnered trust by meeting women in person, offering to pay off their debts and even sending fake digital presentations in an attempt to authenticate his doctor or surgeon persona.

Prosecutors say Wedgeworth posed as a wealthy, single surgeon to build trust with his scam victims. These presentations, published on Issuu, claim he is a Harvard University Ph.D. qualified biochemist. They were published in 2017, the same year Johnson met Wedgeworth as Brian L. Adams before she discovered his true identity and shared her story to local news stations.

Prosecutors say Wedgeworth posed as a wealthy, single surgeon to build trust with his scam victims. These presentations, published on Issuu, claim he is a Harvard University Ph.D. qualified biochemist. They were published in 2017, the same year Johnson met Wedgeworth as Brian L. Adams before she discovered his true identity and shared her story to local news stations.

His actions are similar to those of other high profile and international scammers.

Shimon Heyada Hayut, who called himself Simon Leviev on Tinder and was the subject of the “Tinder Swindler” documentary released on Netflix in February, had a similar strategy.

Hayut, like Wedgeworth, operated primarily on Match Group platforms. He made extravagant financial gestures in order to solicit future funds as favors. He had a website fraudulently linking him to a diamond tycoon and traveled across countries to visit his victims in person and authenticate his simulated identity.

Hayut is accused of scamming several women across Europe for approximately $10 million in just two years. He was sentenced to 15 months in prison in Israel. He only served five months.

Wedgeworth’s indictment said he devised his defrauding scheme from October 2016 through March 2021. Crime and arrest reports from 10 law enforcement agencies show that Wedgeworth began scamming over two decades ago.

At least seven women have filed complaints against him.

His alleged victims were reluctant to share their stories, but their narratives were outlined in police reports. They offer insight into what prosecutors described as Wedgeworth’s target demographic, his use of defrauded funds and his strategy for scamming.

All seven were Black women between the ages of 31 and 43 and lived in middle class households, averaging an annual income between $40,000 and $126,000.

Rather than pose as an entirely different person and target people over 60, Wedgeworth’s accusers said he targeted women within his age group and used his own likeness. He never hid his face or his voice, only his intentions.

Apart from the checks and wire transfers, his indictment said that Wedgeworth defrauded his victims of luxury goods like Rolex watches and a 2018 Sugar Bowl ticket.

“I’m a victim of identity fraud, and the man who stole my identity is a scammer who called fraud ‘the best job in the world,’” said Francesca Gervascio-Franzen, an administrator of the Beware Romance Scammers Facebook group. “He received a sentence of 14 years because his prosecutors were convinced he would go right back to doing it again.”

Gervascio-Franzen has communicated with hundreds of scam victims through the Facebook group in the past year. The page has over 8,500 members and thousands of posts outing scammers. She advises all the group members to report their fraudsters to local and federal law enforcement and guides others through the process. But she said most scammers never get caught.

Romance scamming is becoming a more popular crime. Likelihood of conviction is usually low and the possible profits only grow higher the more people flock to digital dating.

Match Group reported a 25% increase in total revenue from 2020 to 2021 in its annual SEC filings — an even larger increase than the 17% jump from 2019 to 2020. As revenue increases each year by the millions, so does the number of members and, in turn, the likelihood of scams.

The FBI’s Internet Crime Complaint Center said in an annual report that the number of romance scam victims nationwide increased from 18,493 people in pre-pandemic 2018 to 23,751 in 2020.

Access to endless funds and luxuries can be especially enticing when the chances of serving serious time are slim.

Case reports obtained from the Alabama Trial Court System show 46 charges against Wedgeworth. He pleaded guilty to 13 of them. The guilty pleas in Jefferson County date as far back as 1996 and as recently as 2009. His charges include identity theft, forgery, possession of a fraudulent credit card, fraudulent checks and other white collar crimes.

Despite pleading guilty to 13 charges in Alabama alone, Wedgeworth seldom served a full sentence.

The man accused in the scam

Though crime and arrest reports show Wedgeworth has requested indulgent gifts and favors from his victims, there isn’t any evidence he led a life of luxury outside of his faux persona.

Wedgeworth grew up in Birmingham, Alabama. He lived with his parents in a household of five people until his mid-20s.

One Jefferson County court report from Dec. 18, 2009, estimated his personal net worth – including cash on hand and money in his bank accounts – at $1,000. At the time, he paid $164 every month in child support. That child support went up by more than $400 per month in 2013 when he established paternity for another child. All the while, he had no steady stream of income. He has spent the majority of his adult life divorced and unemployed, records show, save for a brief stint with the United States Coast Guard.

The wealthy medical professional who Wedgeworth pretended to be embodies everything that the man allegedly behind the scam is not: financially stable and on the precipice of building a connected family of his own.

Before the financial struggles and the fraud, Wedgeworth’s family said he was an easygoing teenager. He preached at his family’s Baptist church. He played youth football and Little League baseball. He was a popular student at Woodlawn High School – sociable, though still studious.

“I can’t honestly say when things went left,” said his younger sister Juanicca Wedgeworth, “but they did kind of early on, after high school.”

The last time Juanicca spoke to her brother was over a year ago on the phone. She doesn’t have his number; he doesn’t have hers. She said they have not spent a substantial amount of time with one another in over 15 years. Not long after he graduated from Woodlawn, he vanished.

“After adulthood, we haven’t really been in the same place,” she said. “He’s moved around a lot. And we’re adults, we have our own separate lives and children. So we’re not as close.”

She heard news of Wedgeworth’s multiple arrests through family chatter or local news. She said he has never spoken to her about any of the accusations against him. That lack of clarity left her in a gray area. For years, she wondered about his safety and whereabouts. It took a mental toll.

Juanicca said she and her brother grew up with a dysfunctional family. Their parents struggled with marital strife. Their relationship was on and off – the two divorced only to later remarry. Juanicca said she doesn’t think her brother ever got over that.

“I think as adults, we all get to a place where we realize that we need to do some unlearning and unparenting,” she said. “I don’t think Brian has reached that place.”

She said she never suspected her brother as capable of scamming. To her, that means other men she least suspects are capable of the same.

Juanicca worried for herself, her children. If her brother so easily manipulated women online, could the same happen to her? Or worse yet, her now 25-year-old daughter? The thought of someone taking advantage of them filled her with dread.

But two decades ago, she made a conscious effort to stop entertaining those worries. She removed her brother from her mind to remove herself from the equation as a collateral victim.

“I’m at the point now where I’m no longer trying to figure out what’s going on, because that doesn’t serve me,” she said. “I don’t know why he does what he does. I hope this spurs a turning point for him where he snaps out of it and wakes up and realizes that this is not a way of life.

“I don’t think he’s a bad person. I do think he has bad habits and bad ways of thinking and just hasn’t adapted to a good way of living.”

Tiffany Maximin, Tekesia Johnson’s 30-year-old daughter, became a more cautious dater after her mom warned her about Wedgeworth. She said her last relationship was in high school, and she’s not in a rush to meet anyone. She doesn’t plan to meet anyone online, either.

“I haven’t been dating,” she said. “It takes me just a tad bit longer to get to know somebody before I can move forward.”

She avoids repeating her mother’s mistakes. And though Maximin misses Johnson every day – the daily phone calls, the parenting advice, the shoulder to lean on – she is not saddened that the federal indictment arrived when it did. Maximin is convinced her mother played a posthumous role in Wedgeworth’s charges.

“Once she passed away, I think that was her spirit finding him and making sure justice was served,” Maximin said. “That was my mom’s doing. That was her final hurrah.”

| Tamika J. Vinson; Aug. 20, 2004; Morrow County, Ohio

Source: Three count indictment filed by the State of Ohio, Morrow County, against Wedgeworth |

An indictment filed on Nov. 23, 2004 says that Wedgeworth defrauded Tamika Vinson out of $7,300 through her National City VISA and JP Morgan Chase bank cards. One week before, Wedgeworth gifted Vinson a check of $1,500. The check not only bounced, it was listed under the account of another woman — Mamie L. Jackson. |

| Tracy Carter; Jan. 17, 2005; Jefferson County, Alabama

Source: Incident/offense report from Jefferson County Sheriff’s Office |

Tracy Carter reported that she noticed an unauthorized charge of $30 on her Compass Bank account. She contacted the Jefferson County Sheriff’s Department and told the reporting officer that she suspected the charge belonged to an old boyfriend of hers: Brian Wedgeworth.

One month later, on Feb. 22, 2005, she reported missing items. Her red Honda sports bike, HP computer, Acerview monitor, Kodak camera. Officers obtained a search warrant to search Wedgeworth’s home in Birmingham. Wedgeworth was not home, but the officers found all of Carter’s stolen goods. A deposit slip from Carter and Marilyn Sharpe — another possible victim — were also found. A follow-up investigation to Carter’s unauthorized charges from January took place in March. It found that Wedgeworth’s IP address had been traced to the charges: $64.95 for an account on the now defunct dating site “marriedcafe.com” and $30 for a subscription to “islandfreaks.com.” There were other failed attempts to use Carter’s account for a subscription to “pornking.com” and “match.com.” |

| Tracy Allen; June 14, 2006 to July 1, 2006; DeKalb County, Georgia

Source: Incident report from DeKalb County Police Department |

Tracy Allen had a date set with Wedgeworth. The two met online, and Allen told officers she was nervous to meet up with a stranger alone, so the 36-year-old brought a friend with her. They all dined then visited a home Wedgeworth claimed he planned to purchase in Atlanta. The evening seemed to go well. But the next day, Allen reported that Wedgeworth asked her for money.

She refused to pay Wedgeworth, though the two continued seeing one another. Allen reported that Wedgeworth later told her he was looking for a wife. He’d be willing to pay off her debts because he needed to be with someone financially stable. She allowed him to pay off $1,000 she owed on her Delta Community card. The check Wedgeworth used later bounced, leaving Allen to pay off her debt along with an additional $47 fee. Allen told officers Wedgeworth also attempted to obtin a loan for $8,000 on the Delta Community card without Allen’s permission. |

| Jennifer McCollum; Nov. 20, 2011; DeKalb County, Georgia

Source: Incident report from DeKalb County Police Department |

37-year-old Jennifer McCollum met Wedgeworth on Match.com. They had been dating for only two weeks, but she let him stay at her house.

McCollum reported that Wedgeworth offered to pay off one of McCollum’s credit cards with Compass Bank. McCollum said she eyed her account for several days but the deposit never posted. Still, their dates went on. The pair went house hunting on a Saturday in November. The real estate agent who showed McCollum and Wedgeworth properties later contacted McCollum to tell her she should search her partner’s name on Google. Said agent had done so only to find that Wedgeworth was associated with several scams and on probation in Douglasville, Georgia, at the time. McCollum created a plan to turn him in the next day. McCollum let Wedgeworth borrow her black 2007 Nissan Maxima on Sunday morning. She told him to return to her home with the car at 2 p.m. – in time for officers from the DeKalb County Sheriff’s Office to arrest him. But Wedgeworth was late, and at 3:30 he texted McCollum. He said she could pick up the stranded vehicle outside of a nearby Kroger. McCollum’s police report says that Wedgeworth left the vehicle unlocked and alone. Wedgeworth was nowhere to be found. Neither were McCollum’s keys to her car and home. |

| Takiyah Roberts; Sept. 11, 2012 to Sept. 16, 2012; DeKalb County, Georgia

Source: Incident report from DeKalb County Police Department |

When Takiyah Roberts met Wedgeworth online, she says he went by the alias Dr. Brandon King. She reported to officers that the two never met in person, but they spoke to each other over Skype several times. It was enough for Roberts to develop a sense of trust.

Wedgeworth offered to pay off Roberts’ credit card bills. She accepted and shared the information for her Discover, American Express and Capital One accounts with wedgeworth. Wedgeworth attempted to pay $4,756, $4,974. 81 and $4,380.10 to each respective account. Soon after, Roberts reported that the checks bounced. Two days later, Wedgeworth asked Roberts to pay off a bill of his because he told her he couldn’t access his funds. She let him charge $447.94 and $352.36 to her Capital One account. She also sent $3,500 through Moneygram to an account under the name Trina Washington, per his request. In return, Wedgeworth said he would pay off her $29,500 car loan. But that transaction never went through, either. Once Roberts was notified by her bank that none of Wedgeworth’s deposits were going through, she Googled him. Then that trust she had formed with him vanished. |

| Patrice Tanya Thorpe; March 15, 2019 to March 18, 2019; Douglas County, Georgia

Source: Report from Douglas County Sheriff’s Office |

Patrice Thorpe is a single mother, a physician who specializes in family medicine and an immigrant from Jamaica. The 35-year-old is also another one of Wedgeworth’s alleged victims.

She filed a report against Wedgeworth for “threat by deception,” which is considered an act of receiving funds or property by any “deceitful means or artful practice.” This can include a failure to correct a false impression, like that of a false identity. It may also include the promise of an action while knowing said action will not be performed — such as a promise made by a scammer to reimburse someone for “borrowed” funds. By the time Thorpe reported Wedgeworth, he had already developed a reputation in Douglas County, Georgia. He was found and arrested on Oct. 27, 2020, held in custody for a day, then bonded out and released by the Douglas County’s Sheriff’s Office. |

| Delia Allen; March 3, 2021; Clarke County, Georgia

Source: Field case report from Athens-Clarke County Police Department |

Delia Allen joined The League, an online dating platform that claimed to be safer than most. She said she chose that particular platform because the app vets its users. So when she met a self proclaimed cardiothoracic surgeon named Brian Mims on the platform, she told officers she assumed he was legitimate.

Allen reported that Mims was immediately generous with his money, paying her $30,000 for her mortgage, $50,000 for her student loans and taking care of her credit card balance for the month they met. Then Allen said he asked her for a favor. He told her he needed $8,000 to transfer to a colleague for his payroll. Allen reported that he gave her an elaborate excuse. The police report she filed in Clarke County, Georgia last March says that Mims — or Wedgeworth — told Allen his grandfather had recently died and he had just moved from Los Angeles to Atlanta. Dealing with his grandfather’s death and his moving expenses meant he had to make several wire transfers, which his accountant advised him against — “because it would look suspicious.” But he said he needed to pay his colleague’s payroll. And since he “helped her so much recently,” he suggested Allen help him out in return. She sent the wire transfer for $8,000 to the account he requested, one assigned to the name Brian Wedgeworth. Allen grew curious. She Googled the name. She found what other alleged victims before her found: her partner’s face tied to a man convicted of several scams, one with a reputation as a professional swindler. She feared for her safety. Wedgeworth knew where she lived, and after she changed her credit card logins, she says he even reached out to her to ask why. |