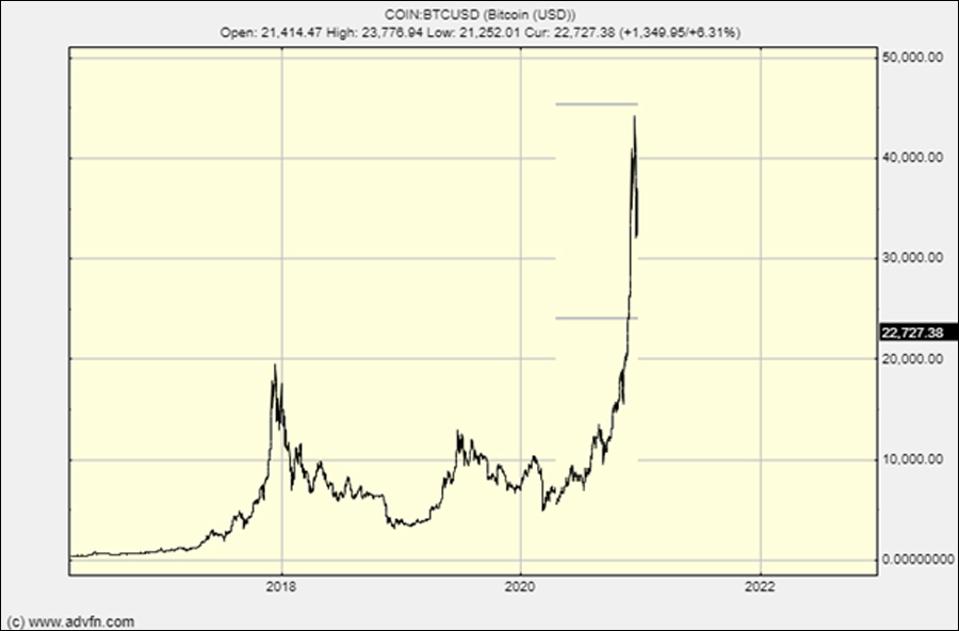

Last week I sold my bitcoin (BTC) and my ether (ETH) and in an article entitled Bitcoin: Time To Exit I said I thought it could go to $40,000 but I didn’t have the nerve for the next 20%.

I said I thought $40,000 was the most likely top but in effect I didn’t care because I had to sell to keep to the law of diversification.

Here is the chart:

This was my prediction fro bitcoin’s top

Credit: ADVFN

The file name is even called “BTC top.”

In November I wrote about a rise to $40,000 and a fallback to perhaps as low as $5,000, although $10,000 is probably savage enough and anything below $20,000 starts to get interesting again for a DCA (dollar cost averaging) strategy. Well, I do not claim clairvoyance but it will look pretty good on Forbes in the coming years.

So I think I have earned another ticket on calling what is next. To put it bluntly, I think it’s all over for this run.

Crypto is now a trade not an investment and will stay that way for a long time. The price could and probably will go all over the place but it is unlikely to go far above the recent high and it is extremely unlikely to maintain or beat a level of $40,000-$50,000 if it does. BTC won’t make its next significant high until the next halvening— scheduled for 2024—and that will see us in a different world. I think bitcoin will repeat the fallback it suffered in 2017 just as the rise of that bubble has repeated.

There is a caveat: If inflation runs wild then price predictions are irrelevant. A picture paints a thousand words and inflation of any scale will warp any prediction unless you want the complexity and fuzziness of inflation adjustment.

Yugoslav bank note with many, many zeros

Credit: Clem Chambers

That aside, as I write BTC is $35,000, up from yesterday’s $30,000 and a bit.

Believers will say, this is what bitcoin does; it is now going up to $200,000. Sadly I don’t think that is in the cards. It does well to remember that U.S. M1 (cash) is just $7 trillion and was only $4 trillion before Covid. Bitcoin will not compete with that scale in the next few months so $200,000 a coin is a wildly unlikely destination on any relevant timescale.

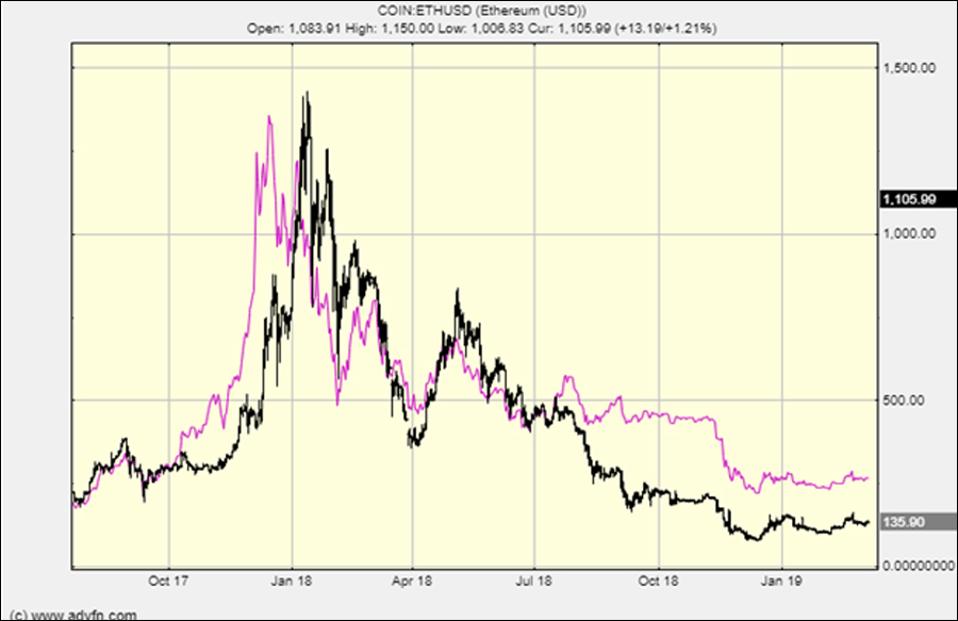

It was sad to sell out and I reentered ether the next day but sold out on Sunday after a most fortunate decision to give up on being stretched on the rack by the wild volatility. Ether could run on up for a few weeks after the top of bitcoin as it did in the last bubble. Worried but passionate bitcoiners will likely flip into ether in the belief there is upside there and temporary safety from a bitcoin crash. I took that route last week but it was simply gambling and I sobered up in time to miss out on getting kicked in the teeth, although as I write ether is holding up pretty well as might be expected in the short term.

This is how ETH vs. BTC played out last time, and you can see the ether lag:

Bitcvoin vs Ethereum in the last peak

Credit: ADVFN

If you want to try and play that game it’s there to be had, but for me my trading nerves have gone with the brown in my hair. The joint destiny of bitcoin and ether is going to part company over the next few months because while bitcoin is gold, Ethereum is a platform, the core brand and engineering for “decentralized apps”—a giant technological wave about to sweep the globe. Ethereum does not owe its future to bitcoin anymore.

Meanwhile I now expect bitcoin to start to flag and to descend below $20,000 where I will probably start to buy it slowly again towards 2024 and the next halvening.

Even if BTC regains its high and plateaus at say $60,000, something I find very unlikely, the upside is in DeFi where there will be a carnival of incredible opportunities to make multiples on your investments.

That is where I’ve gone and as soon as the main storm passes that is where I’ll be acquiring tokens, whatever the price of bitcoin and ether might be at the time.

If it is there at all, BTC and ETH’s upside is now bounded, while in “decentralized finance” the moon is still to be had for many of the tokens.